Limited interest and dividend income reported on a 1099-INT or 1099-DIV.The following tax situations are not included in the TurboTax Free Edition: However, some tax situations aren't covered and therefore don't qualify. Unemployment income reported on a 1099-G.Credits, deductions, and income reported on schedules 1-3.TurboTax Free Edition is available the entire tax season.

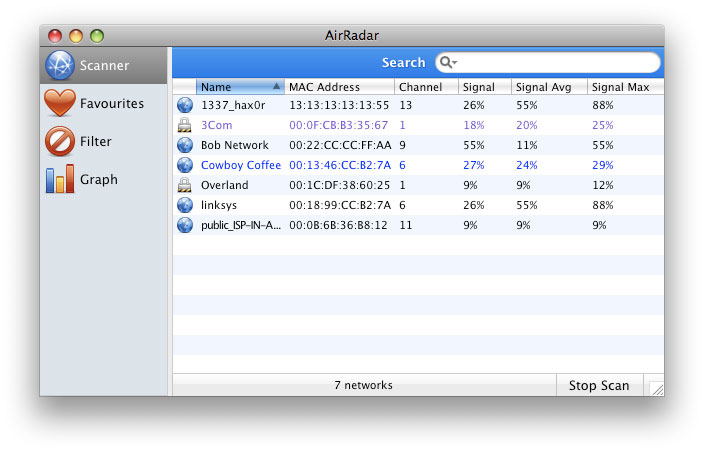

EASIEST AIRRADAR DIY FULL

File a simple return with TurboTax Live Full Service Basic by Feb. If you need extra help with your taxes, TurboTax Live Full Service Basic may work well for you. With this option, you'll be virtually paired up with a tax expert who will take care of your tax return for you.

EASIEST AIRRADAR DIY UPDATE

#TURBOTAX DISCOUNT CODE FIDELITY UPDATE#Īll you need to do is submit your tax documents, and your tax expert will update you every step of the way as they prepare your taxes.

EASIEST AIRRADAR DIY FOR FREE

TurboTax is offering this product for free for taxpayers with simple returns for a limited time. If you qualify for a simple return and file by Feb. File a simple return with TurboTax Live Basic by March 31 15, 2022, this service will cost you $0 for a federal and state tax return. TurboTax is also offering its TurboTax Live Basic product at no cost for qualifying federal and state returns for a limited time. You'll need to file your return by March 31, 2022, and you'll need to have a simple return to be eligible to use this service. With this option, you can prepare your taxes while getting some assistance. As you prepare your return, you can chat with a tax expert. You can also set up a time to video chat. A tax expert will also review your tax return before filing it. If you qualify for a simple return and file before March 31, 2022, this service will cost you $0.

Free tax filing available for active military members and reservistsīut that's not all. You qualify for free income tax filing through TurboTax if you're an enlisted active duty military member or reservist. This includes both federal and state tax return filing through the following online products:Ĭommissioned officers, warrant officers, veterans, and retirees don't qualify for free tax filing. Read our TurboTax review if you're thinking of filing your taxes with TurboTax. No matter how you choose to file, check to see if you qualify for free filing before you prepare your tax return. You could save yourself money if you are eligible for free filing.

#TURBOTAX DISCOUNT CODE FIDELITY FOR FREE# If the above offerings don't work for your tax situation, the IRS Free File program is another option to consider.

Eligible taxpayers who have an adjusted gross income (AGI) of $73,000 or less can file a federal return at no cost through participating tax preparation companies. If you still need to file your income taxes, these are the best tax software options available. #TURBOTAX DISCOUNT CODE FIDELITY SOFTWARE# The hypothetical company accounts are based on historical results from January just one, 2010 to Mar 31, 2020.Learn which details to look away for when preparing your current returns.We may receive compensation in the event you apply through the links.

0 kommentar(er)

0 kommentar(er)